See in two articles below the recent comments about the foundry business model. I explained some of the issues in my March 18, 2012 blog post - Moore's Law End? (Next semiconductors gen. cost $10 billion)

Additional articles included in recent blog posts

1. Nvidia #1 at TSMC Fab? Nvida has Priority for 28nm capacity

2. Nvidia: TSMC 20nm Essentially Worthless

3.Intel: "Fabless model collapsing". Is it correct?

Ron

Qualcomm Weighs Writing ‘Big Checks’ to Ensure Chip Access

http://www.businessweek.com/news/2012-06-27/qualcomm-weighs-writing-big-checks-to-ensure-parts-supply

By Ian King on June 28, 2012

Qualcomm Inc. Chief Executive Officer Paul Jacobs, girding against a shortage of chips, said he wouldn’t rule out owning a manufacturing plant or tapping the company’s cash pile to ensure access to needed parts.

Qualcomm is weighing different business arrangements with its suppliers and would consider “writing big checks,” Jacobs said yesterday at a briefing in San Diego, where the company is based.

“If that’s what it took in the future, I wouldn’t say no to that,” Jacobs said. Qualcomm would prefer to keep relying on other companies to make its chips, rather than building plants, he said.

“It’s not something that’s high on our list of things that we want to do. But I wouldn’t rule it out completely.”

Qualcomm is the biggest in a growing group of chip companies that focus on designing chips and leave the manufacturing to other companies, usually so-called foundries in Asia. As smartphone demand surges, parts suppliers are struggling to keep up. That has prompted electronics makers such as Apple Inc. (AAPL) (AAPL) to use cash payments to the tune of hundreds of millions of dollars to secure their quota.

“The gut reaction of investors to Qualcomm building a fab would be negative -- it would be changing their business model,” said Daniel Berenbaum, an analyst at MKM Partners LLC. Using upfront payments to lock down supply from existing partners would be a “judicious use of cash,” he said.

Higher Orders

Qualcomm said earlier this year that earnings growth will be constrained because it can’t get enough chips from Taiwan Semiconductor Manufacturing Co. The company had received more orders than anticipated for chips made with the most advanced manufacturing processes.

Jacobs said that while supply is improving and Qualcomm may be able to provide enough chips to match demand for phones by the end of the year, some customers will miss planned introductions of phones -- even as fresh orders for those chips roll in.

Jacobs also said yesterday that devices powered by Qualcomm’s Snapdragon processors will be available later this year, when Microsoft Corp. (MSFT) (MSFT) releases its Windows RT software. Snapdragon will run some of the thinnest and lightest computers available, he said.

Qualcomm is one of three chip companies partnering with Microsoft to develop devices using processors based on ARM Holdings Plc (ARM) technology. Microsoft is enabling ARM-based chips, which dominate mobile phones and are the heart of Apple’s iPad, in a computer operating system for the first time.

ARM Tablets

Nvidia Corp. (NVDA) (NVDA) and Texas Instruments Inc. (TXN) (TXN) are also working with Microsoft to deliver ARM-based computers and tablets. Intel Corp. and Advanced Micro Devices Inc. (AMD) (AMD), whose processors have traditionally run Windows computers, are working on a similar Microsoft touch-screen operating system.

Windows 8, for Intel and AMD chips, and Windows RT, for ARM-based chips, are Microsoft’s first computer operating systems designed for touch displays.

Qualcomm (QCOM) (QCOM) declined 0.9 percent to $54.41 at 9:36 a.m. in New York. Through yesterday, the shares were little changed this year.

Google Inc. yesterday said it will use a Tegra processor from Nvidia for its Nexus tablet computer based on an updated version of the Android software. That followed Microsoft’s choice of Tegra for its Surface tablet.

Qualcomm’s Jacobs said those decisions came before Qualcomm released an update to Snapdragon. That chip, with two processing cores, outperforms Tegra, which has four, he said.

Dual Core

“It was a timing thing,” he said. “Our dual core is better than their quad core.”

“Nvidia will let its design wins speak for themselves,” said Hector Marinez, a spokesman for the Santa Clara, California-based company.

Qualcomm is restructuring to form a parent company, which will include corporate operations and most of its patent portfolio, as well as a wholly owned subsidiary to operate research and development and run its products, services and semiconductor businesses, the company said in a statement today.

“Our internal reorganization will provide even greater protection for our industry-leading intellectual property portfolio as our products and services businesses seek to accelerate innovation and deliver our products to market quickly,” Jacobs said in the statement.

Samsung Semiconductor Calls for New Foundry Business Model.

Samsung Predicts Closer Collaboration Between Chip Designers and Foundries

http://www.xbitlabs.com/news/other/display/20120626234631_Samsung_Semiconductor_Calls_for_New_Foundry_Business_Model.html

[06/26/2012 11:46 PM]

by Anton Shilov

As chips become more complex while process technologies thinner and trickier, it becomes harder for fabless chip companies and contract makers of semiconductors to interact and consequently ramp up production of new chips quickly. With the emergence of 450mm wafer production and FinFET transistors, the collaboration between foundries and clients should become different, believes Samsung Semiconductor.

"There is no doubt we are at a crossroads at the most advanced process technology nodes. In order to take positive steps forward, significant monetary and collaborative investments and resources are required from both the manufacturing and design sides of the equation," said Ana Hunter, vice president of Samsung’s North American foundry services.

Intel recently predicted that due to dramatically increasing complexities of semiconductors and process technologies the foundry model would collapse in the coming years and only integrated device manufacturers (IDMs) will be able to make leading-edge chips using leading-edge manufacturing technologies. Nonetheless, given the fact that contract makers of chips are increasing their purchases of manufacturing equipment, it appears that they do not believe in the collapse of the industry. In fact, since fewer companies going forward will be able to afford own fabs, it is clear that the amount of clients for foundries will increase.

Samsung Semiconductor thinks that a new approach to doing business is in order to stay competitive with pure IDMs. The foundry industry has taken huge strides on the ecosystem side to ensure that physical IP, libraries and design flows are all in place as a new process node comes online. That tight working relationship needs to be pushed beyond the partner ecosystem to include the customer’s design teams.

For faster product rollout and ramp to high-volume manufacturing at the most advanced process nodes, integrated relationships between the foundry and its strategic customers where quasi-IDM operating procedures are established is key to the health and growth of the foundry industry, believes Ana Hunter, who works with clients (such as Apple) of Samsung Semiconductor's U.S.-based unit on daily basis. Fabless companies and foundries need to collaborate on the factors that allow products to be manufacturable, crossing traditional customer and vendor barriers. In fact, this is already happening as leading fabless companies learn from experience that closer integration with foundry design flows and kits, starting very early in the development cycle, enables faster feedback and improvement to both the product design and the manufacturing process.

"The industry is at an inflection point and the model is changing. A more simulated IDM environment will allow fabless semiconductor companies to be more competitive at the advanced process nodes. As an IDM foundry, Samsung is keenly aware of the advantages that can be gained by this approach. We strive to deliver these benefits to our foundry customers," concluded Ms. Hunter.

Commentary on Semiconductor industry at the confluence of Process, Product, and Circuits design

Contact Info.

Semiconductor Information and Business News at http://maltiel-consulting.com/

mailto:ron@maltiel-consulting.com

Phone / Fax : (408) 446 - 3040

mailto:ron@maltiel-consulting.com

Phone / Fax : (408) 446 - 3040

Friday, June 29, 2012

Wednesday, June 27, 2012

Microsoft: Million+ PC, Laptop, DRAM failures

The report below shows the results of Microsoft's analysis of the crash data sent back to Redmond from over a million PCs.

It is interesting that laptops didn't crash as often as desktops in the study. This is especially surprising considering that 1/3 of laptops fail in the first 3 years (article I read about a year ago).

Ron

Microsoft analyzes over a million PC failures, results shatter enthusiast myths

http://www.extremetech.com/gaming/131739-microsoft-analyzes-over-a-million-pc-failures-results-shatter-enthusiast-myths

By Joel Hruska on June 26, 2012 at 4:10 pm

Researchers working at Microsoft have analyzed the crash data sent back to Redmond from over a million PCs. You might think that research data on PC component failure rates would be abundant given how long these devices have been in-market and the sophisticated data analytics applied to the server market — but you’d be wrong. According to the authors, this study is one of the first to focus on consumer systems rather than datacenter deployments.

What they found is fascinating. The full study [1] is well worth a read; we’re going to focus on the high points and central findings. There are two limitations to the data collected that we need to acknowledge. First, the data set we’re about to discuss is limited to hardware failures that actually led to a system crash. Failures that don’t lead to crashes are not cataloged. Second, the data presented here is limited to hardware crashes, with no information on the relative frequency of software to hardware crashes.

CPU overclocking, underclocking, and reliability

When it comes to baseline CPU reliability, the team found that the chance of a CPU crashing within 5 days of Total Accumulated CPU Time (TACT) over an eight month period was relatively low, at 1:330. Machines with a TACT of 30 days over the same 8 months of real-time have a higher failure rate, of 1:190. Once a hardware fault has appeared once, however, its 100x more likely to happen again, with 97% of machines crashing from the same cause within a month.

Overclocking, underclocking, and the machine’s manufacturer all play a significant role in how likely a CPU crash is. Microsoft collected data on the behavior of CPUs built by Vendor A and Vendor B (no, they don’t identify which is which). Here’s the comparison chart, where Pr[1st] is the chance of the first crash, Pr[2nd1] the chance of a second subsequent crash, Pr[3rd2] the chance of a third failure. In this case, overclocking is defined as running the CPU more than 5% above stock.

Are Intel chips just as good as AMD chips? At stock speeds, the answer is yes. Once you start overclocking, however, the two separate. CPU Vendor A’s chips are more than 20x more likely to crash at OC speeds than at stock, compared to CPU Vendor B’s processors, which are still 8x more likely to crash. The report notes that “After a failure occurs, all machines, irrespective of CPU vendor or overclocking, are significantly more likely to crash from additional machine check exceptions.” The team doesn’t break out overclocking failures by percentage above , but their methodology does prevent Turbo Boost/Turbo Mode from skewing results. Does overclocking hurt CPU reliability? Obviously, yes.

So what about underclocking? Turns out, that has a significant impact on CPU failures as well.

As you can see, underclocking the CPU has a significant impact on failure rates. The impact on DRAM might seem puzzling — the researchers only reference CPU speed as a determinant of underclocking, rather than any changes to DRAM clock rate. Our guess is that the sizable impact on DRAM is caused by a slower CPU alone rather than any hand-tuning of RAM clock, RAM latency, or integrated memory controller (IMC) speed. IMC behavior varies depending on CPU manufacturer and product generation in any case, while the size of the study guarantees that a sizable number of Intel Core 2 Duo chips without IMCs would still been part of the sample data.

Laptops vs. desktops, OEM vs. white box

Ask enthusiasts what they think about systems built by Dell, HP, or any other big brand manufacturer, and you aren’t likely to hear much good. Actual data proves that major vendors actually have fewer problems than the systems built by everyone else. The researchers identified the Top 20 computer OEMs as “brand names” and removed overclocked machines from the analysis of the data. Only failure rates within the first 30 days of TACT were considered among machines with at least 30 days of TACT. This is critical because brand name boxes have an average of 9% more TACT than white box systems, which implies that the computers are used longer before being replaced.

White box systems don’t come off looking very good in these comparisons. CPUs are significantly more likely to fail, as is RAM. Disk reliability remains unchanged.

How about laptops? The researchers admitted that they expected desktops to prove more reliable than laptops due to the rougher handling of mobile devices and the higher temperatures such systems must endure. What they found suggests that laptop hardware is actually more reliable than desktop equipment, despite the greater likelihood that mobile systems will be dropped, sat on, or eaten by a bear. Again, overclocked systems were omitted from the comparison.

Desktops don’t come off looking very good here despite their sedentary nature. The team theorizes that the higher tolerances engineered into the CPU and DRAM, combined with better shock-absorbing capabilities in mobile hard drives may be responsible for the lower failure rate. The difference between SSDs and HDDs was not documented.

More data needed

The limitations of the study are such that we can’t draw absolute conclusions from this data, but they suggest a need for better analysis tools and indicate that adopting certain technologies, like ECC, would help improve desktop reliability. It’s one thing to say that overclocking hurts CPU longevity; something else to see that difference spelled out in data. The impact of underclocking was also quite surprising, this is the first study we’re aware of to demonstrate that running your CPU at a lower speed reduces the chance of a hardware error compared to stock.

The Microsoft team conducted the research as one step towards the goal of building operating systems and machines that are more tolerant of hardware faults. The fact that systems which throw these types of errors are far more likely to continue doing so strikes at the idea that such problems are random occurrences, as does much of the reliability information concerning DRAM.

The report throws doubt on a good deal of “conventional” wisdom and implies reliability is rather sorely lacking. More data is needed to determine why that is, and to correct the problem.

Endnotes

full study: http://research.microsoft.com/apps/pubs/default.aspx?id=144888

: http://www.extremetech.com/wp-content/uploads/2012/06/AMD-vs-Intel.png

: http://www.extremetech.com/wp-content/uploads/2012/06/Underclocking.png

: http://www.extremetech.com/wp-content/uploads/2012/06/Brand-vs-whitebox.png

: http://www.extremetech.com/wp-content/uploads/2012/06/Desktops-vs-Laptops.png

It is interesting that laptops didn't crash as often as desktops in the study. This is especially surprising considering that 1/3 of laptops fail in the first 3 years (article I read about a year ago).

Ron

Microsoft analyzes over a million PC failures, results shatter enthusiast myths

http://www.extremetech.com/gaming/131739-microsoft-analyzes-over-a-million-pc-failures-results-shatter-enthusiast-myths

By Joel Hruska on June 26, 2012 at 4:10 pm

Researchers working at Microsoft have analyzed the crash data sent back to Redmond from over a million PCs. You might think that research data on PC component failure rates would be abundant given how long these devices have been in-market and the sophisticated data analytics applied to the server market — but you’d be wrong. According to the authors, this study is one of the first to focus on consumer systems rather than datacenter deployments.

What they found is fascinating. The full study [1] is well worth a read; we’re going to focus on the high points and central findings. There are two limitations to the data collected that we need to acknowledge. First, the data set we’re about to discuss is limited to hardware failures that actually led to a system crash. Failures that don’t lead to crashes are not cataloged. Second, the data presented here is limited to hardware crashes, with no information on the relative frequency of software to hardware crashes.

CPU overclocking, underclocking, and reliability

When it comes to baseline CPU reliability, the team found that the chance of a CPU crashing within 5 days of Total Accumulated CPU Time (TACT) over an eight month period was relatively low, at 1:330. Machines with a TACT of 30 days over the same 8 months of real-time have a higher failure rate, of 1:190. Once a hardware fault has appeared once, however, its 100x more likely to happen again, with 97% of machines crashing from the same cause within a month.

Overclocking, underclocking, and the machine’s manufacturer all play a significant role in how likely a CPU crash is. Microsoft collected data on the behavior of CPUs built by Vendor A and Vendor B (no, they don’t identify which is which). Here’s the comparison chart, where Pr[1st] is the chance of the first crash, Pr[2nd1] the chance of a second subsequent crash, Pr[3rd2] the chance of a third failure. In this case, overclocking is defined as running the CPU more than 5% above stock.

Are Intel chips just as good as AMD chips? At stock speeds, the answer is yes. Once you start overclocking, however, the two separate. CPU Vendor A’s chips are more than 20x more likely to crash at OC speeds than at stock, compared to CPU Vendor B’s processors, which are still 8x more likely to crash. The report notes that “After a failure occurs, all machines, irrespective of CPU vendor or overclocking, are significantly more likely to crash from additional machine check exceptions.” The team doesn’t break out overclocking failures by percentage above , but their methodology does prevent Turbo Boost/Turbo Mode from skewing results. Does overclocking hurt CPU reliability? Obviously, yes.

So what about underclocking? Turns out, that has a significant impact on CPU failures as well.

As you can see, underclocking the CPU has a significant impact on failure rates. The impact on DRAM might seem puzzling — the researchers only reference CPU speed as a determinant of underclocking, rather than any changes to DRAM clock rate. Our guess is that the sizable impact on DRAM is caused by a slower CPU alone rather than any hand-tuning of RAM clock, RAM latency, or integrated memory controller (IMC) speed. IMC behavior varies depending on CPU manufacturer and product generation in any case, while the size of the study guarantees that a sizable number of Intel Core 2 Duo chips without IMCs would still been part of the sample data.

Laptops vs. desktops, OEM vs. white box

Ask enthusiasts what they think about systems built by Dell, HP, or any other big brand manufacturer, and you aren’t likely to hear much good. Actual data proves that major vendors actually have fewer problems than the systems built by everyone else. The researchers identified the Top 20 computer OEMs as “brand names” and removed overclocked machines from the analysis of the data. Only failure rates within the first 30 days of TACT were considered among machines with at least 30 days of TACT. This is critical because brand name boxes have an average of 9% more TACT than white box systems, which implies that the computers are used longer before being replaced.

White box systems don’t come off looking very good in these comparisons. CPUs are significantly more likely to fail, as is RAM. Disk reliability remains unchanged.

How about laptops? The researchers admitted that they expected desktops to prove more reliable than laptops due to the rougher handling of mobile devices and the higher temperatures such systems must endure. What they found suggests that laptop hardware is actually more reliable than desktop equipment, despite the greater likelihood that mobile systems will be dropped, sat on, or eaten by a bear. Again, overclocked systems were omitted from the comparison.

Desktops don’t come off looking very good here despite their sedentary nature. The team theorizes that the higher tolerances engineered into the CPU and DRAM, combined with better shock-absorbing capabilities in mobile hard drives may be responsible for the lower failure rate. The difference between SSDs and HDDs was not documented.

More data needed

The limitations of the study are such that we can’t draw absolute conclusions from this data, but they suggest a need for better analysis tools and indicate that adopting certain technologies, like ECC, would help improve desktop reliability. It’s one thing to say that overclocking hurts CPU longevity; something else to see that difference spelled out in data. The impact of underclocking was also quite surprising, this is the first study we’re aware of to demonstrate that running your CPU at a lower speed reduces the chance of a hardware error compared to stock.

The Microsoft team conducted the research as one step towards the goal of building operating systems and machines that are more tolerant of hardware faults. The fact that systems which throw these types of errors are far more likely to continue doing so strikes at the idea that such problems are random occurrences, as does much of the reliability information concerning DRAM.

The report throws doubt on a good deal of “conventional” wisdom and implies reliability is rather sorely lacking. More data is needed to determine why that is, and to correct the problem.

Endnotes

full study: http://research.microsoft.com/apps/pubs/default.aspx?id=144888

: http://www.extremetech.com/wp-content/uploads/2012/06/AMD-vs-Intel.png

: http://www.extremetech.com/wp-content/uploads/2012/06/Underclocking.png

: http://www.extremetech.com/wp-content/uploads/2012/06/Brand-vs-whitebox.png

: http://www.extremetech.com/wp-content/uploads/2012/06/Desktops-vs-Laptops.png

Labels:

cache,

Circuit,

circuit expert,

circuit experts,

DRAM,

failures,

hard drive,

HDD,

laptop,

Memory,

Microsoft,

overclocking,

PC,

testify,

testimony,

underclocking

Thursday, June 21, 2012

Status of China's Fabless Model

The large demand for smartphone chips in China will cause local Chinese design houses to grow faster in the next few years.

Ron

source: IC Insights

Is China's fabless model sustainable?

http://www.eetimes.com/electronics-news/4375636/Is-China-fabless-model-sustainable?pageNumber=1

Junko Yoshida

6/19/2012 9:11 AM EDT

How many U.S. design engineers can name, say, the top 10 Chinese chip vendors destined to become their fierce competitors in three years from now? BEIJING -- Let’s face it. China’s IC industry still lacks its own superstars – equivalent to Intel, Qualcomm or Broadcom in the West – in terms of the scale, reach and quality these brands possess on the global market.

To belabor the point, how many U.S. design engineers can name, say, the top 10 Chinese chip vendors destined to become their fierce competitors in three years from now? The question is tough because Chinese fabless companies, while growing fast, are still small. Many also remain faceless.

In contrast, a Chinese executive based in Beijing, speaking with ee Times, rattled off Spreadtrum, RDA Microelectronics, GalaxyCore and GigaDevice as his “top four” picks among local fabless companies likely to become key players in the smartphone IC ecosystem. The executive, heading up a U.S.-based chip company’s R&D team, believes that will happen not within the decade, but in just a few years.

Is he right?

EE Times has talked to several movers and shakers in China’s semiconductor industry in recent weeks. While our investigation is still in progress, we’ll be reporting our ongoing findings in a two-part series. First, we examine the state of the Chinese fabless industry -- covering how they’ve gotten to where they are today. In part two, we discuss what Chinese semiconductor companies must do in order to cross the chasm – from local heroes in China to power players on the global stage.

On one hand, some multinationals like Synopsys (EDA vendor), VeriSilicon (“Design-Lite” service company) and ARM (IP supplier) are well positioned to leverage local engineering resources to respond to Chinese fabless companies’ always pressing (and almost impatient) need to get ahead more quickly.

On the other, Chinese startups, still in early days, lack a portfolio of their own IPs. Consequently, “they tend to compete on price with similar products in the same application fields,” observed Jian-Yue Pan, corporate vice president, Asia Pacific region of Synopsys.

Meanwhile, some China fabless are coming up with fresh ideas (i.e.Apexone), operating with an incredible work ethic and directing a fanatical focus on customer service (i.e. Awinic). Companies like RDA, Spreadtrum and Rockchip are growing like gangbusters.

It’s important to note that there is nothing monolithic about China or China’s fabless companies. Over the last two decades, a number of Chinese chip companies – some well known in the West – had distinct trajectories, with a full array of ups and downs. Some disappeared and others thrived, their fates depending on when each company was born, how it was managed, and whether the ecosystem in China was sufficient to spur growth.

Synopsys’ Pan turns out to be as good a student and observer of the Chinese semiconductor industry as any, since he has lived through the rise of the industry over the last 17 years while working at Synopsys in China.

Pan isn’t a returnee – like many other China fabless executives today who were born in China and came to the United States for graduate degrees, before going home again to help nurture the Chinese industry.

Pan is home-grown. He has worked his entire professional life in China, rather than in Silicon Valley, after graduation from the nation’s elite Tsinghua University in early the 1990’s.

Chinese fabless companies have come a long way

In the interview, Pan said, “A lot of things have happened. Over the last 17 years, we saw the rise of the Korean chip industry, and the decline of Japanese companies.” To illustrate the rise of the Chinese semiconductor industry, Pan divided the last 17 years in three periods: “incubation” (1995 – 2001); “breakthrough” (2001 – 2007); and “acceleration” (2007 – 2012).

Incubation

During the incubation period, virtually all the companies taking part in the Chinese semiconductor industry were state-owned. They were largely pushed, prompted and nurtured by Chinese government’s industrial policy and technology transfers from other countries including the United States, Europe and Japan.

During this period, the total revenue of the Chinese IC design houses was “less than $100 million,” according to Pan.

Nonetheless, several important milestones helped pave the way for the birth of the Chinese semiconductor industry. They include: the completion of technology transfer between Lucent and Huajing in 1997, allowing Huajing—located in Wuxi in Jiangsu Province—to start producing 6-inch CMOS wafers with 0.9 micron design rules. By 1999, SDRAM production started on the 8-inch wafer fab at HHNEC (Hua Hong NEC Electronics Co.) using a 0.35 micron process technology. These were days when few indigenous fabless companies existed in China. These fabs had to depend on the international semiconductor community for consumption, as well as for technical support.

But the most significant milestone of all during this period, according to Pan, was the emergence of the Chinese central government’s “Policy No. 18.” Put in place in July, 2000, the directive was a top-down order to “encourage the development of the IC industry in China,” explained Pan. Under Policy 18, the government offered favorable tax treatment to domestically produced IC chips, while providing heavy government investment in infrastructure, education and basic research.

As a result, seven state-owned incubation centers for IC design sprang up, with Synopsys coming out as one of the big beneficiaries. It turns out that the seven state-owned IC design centers standardized their design flow environment on Synopsys tools, making Synopsys the government’s favored tool designer.

Breakthrough

The following six years (2001 – 2007) is when the Chinese semiconductor industry saw a number of breakthroughs, fueled by the growth of the Chinese economy and adherence to Policy 18. Pan observed that in 2000, there were fewer than 100 fabless companies in China. But 2003, more than 450 fabless had vendors popped up. Also emerging was China’s strategic mimicry of the Silicon Valley model, using stock-based compensation to incentivize managers and engineers in high-tech companies.

In 2003, Hangzhou Silan Microelectronics Co., Ltd, popularly known as Silan Corporation, became the first IC vendor on the Shanghai Stock Exchange. Silan successfully made an IPO, initiated with 26 million shares of series A-stock

By 2006, both Vimicro International Corporation and Actions Semiconductor had gone through a rigorous IPO process and got listed in Nasdaq. In 2007, Spreadtrum went public and joined the Nasdaq club.

Acceleration

Pan now sees the Chinese semiconductor industry in its third phase, where everything is accelerating. There are five more Chinese companies on a wait-list to go public on Nasdaq.As of 2011, China had close to 500 fabless chip companies, with total revenue last year at “give or take, close to $10 billion,” Pan said.

Where do they go from here?

Over the last three years, “some startups – including GigaDevice, GalaxyCore, RDA and Rockchip – have grown very fast,” according to Datong Chen, co-founder and managing director of West Summit Capital in Beijing. There is no dispute about that

The question, however, is how sustainable it is for these companies to continue to grow so rapidly. How many more years can Chinese companies continuously keep gross margin low and perpetually work harder in order to bring down the cost of their products in hopes of beating out foreign competition?

In the top 20 fabless IC companies’ ranking for 2011 (put together by IC Insights), only two from China, HiSilicon and Spreadtrum, showed up.

Top 20 fabless IC companies in 201

source: IC Insights

Datong has experienced firsthand the rise of the Chinese chip industry, as he was the co-founder and CTO of Spreadtrum Communications. Prior to Spreadtrum, Datong was the co-founder and senior vice present for Omnivision, a leading developer of CMOS imaging sensor.

For Chinese fabless companies to sustain current growth, Datong said, “They need a bigger platform.” By “platform,” he means, “Money, a larger market size, and a bigger customer base.” Then, he added, “Of course, it’s better if they do IPOs – because that will allow them to get fair market value, it would make it much easier for them to do acquisitions, and they will get more trust from the market.”

The potential for Chinese fabless companies to reap greater rewards are already here, according to Allen Wu, president of ARM China. ARM-based SoCs, designed by Chinese fabless companies and shipped globally, jumped from 30 million units in 2007 to 615 million units in 2011.

And yet, Wayne Dai, president and CEO of VeriSilion, calls the Chinese semiconductor industry a “no-man’s-land of fabless companies.” He explained that most of the 400+ China fabless companies are living through a 'no man’s land,' which he describes "an inflection point for a start up’s life cycle.

In his view, "[Chinese fabless companies] are too big to be small, but too small to be big." In other words, "If they can’t continue to grow, evolving into firms that dramatically change their marketplace or define a new category, they have to either stay small or sell to a larger company. Otherwise, they are going out of business within the next two years."

In essence, most Chinese fabless companies remain too stubbornly small to exploit the market’s size. There lies the conundrum.

In part two of this article, we’ll discuss prescriptions—what steps Chinese fabless companies must take, and conversely, what actions multinationals should take to survive among all those Chinese go-getters.

Wednesday, June 20, 2012

Flash Memory Controller is the Secret Sauce

This is the the fifth SSD controller company to be acquired recently:

* In March of last year OCZ acquired Indilinx

* In may 2011 SanDisk bought Pliant

* LSI acquired SandForce in October

* December brought Apple's acquisition of Anobit

* Now SK Hynix has acquired Link_A_Media

At the Flash Summit in August 2011, Sandisk discussed The Future of SSD Architectures. Several of the key technical issues of a flash NAND memory controller were highlighted.

Having controller knowledge in-house is a key edge in designing fast and low power flash memory systems.

Ron

SK Hynix to Acquire Link_A_Media Devices

http://finance.yahoo.com/news/sk-hynix-acquire-media-devices-222500217.html

SEOUL, South Korea--(BUSINESS WIRE)--

SK hynix Inc. (‘SK hynix’ or ‘the Company’) announced that it has entered into an agreement to acquire California-based storage solution company Link_A_Media Devices Corporation (‘LAMD’). LAMD, founded in 2004, is a leader in the development of semiconductor system-on-chip (SoC) solutions for the data storage market. These SoC solutions, also called controllers, interface with processors to significantly increase the speed and reliability of Flash memory. Upon completion of the acquisition, LAMD will join SK hynix as a business unit focused on customized NAND based solutions.

As various mobile applications such as smartphones and tablet PCs are being rapidly adopted and cloud computing grows in popularity, the NAND Flash market has been evolving from raw NAND memory solutions for USB and memory cards to value-added products equipped with controllers. The role of the NAND controller in premium products such as e-MMC (embedded Multi Media Card) and SSDs (Solid State Drives) has become increasingly important to meet the high memory densities and improved interface speeds required by end users.

“We expect our NAND Flash competitiveness will be further strengthened by the acquisition of LAMD which has extensive expertise in controller technology and excellent engineering resources. SK hynix will leverage this acquisition and continuously develop value-added NAND solutions and respond to our customers’ needs,” said Mr. Oh Chul Kwon, President and CEO of SK hynix.

“We are excited to become a part of the SK hynix family. This will enable us to bring our advanced controller solutions to a wide range of data storage products to meet the rapidly increasing demands of the worldwide business and consumer markets,” said Dr. Hemant Thapar, Founder and CEO of LAMD.

* In March of last year OCZ acquired Indilinx

* In may 2011 SanDisk bought Pliant

* LSI acquired SandForce in October

* December brought Apple's acquisition of Anobit

* Now SK Hynix has acquired Link_A_Media

At the Flash Summit in August 2011, Sandisk discussed The Future of SSD Architectures. Several of the key technical issues of a flash NAND memory controller were highlighted.

Having controller knowledge in-house is a key edge in designing fast and low power flash memory systems.

Ron

SK Hynix to Acquire Link_A_Media Devices

http://finance.yahoo.com/news/sk-hynix-acquire-media-devices-222500217.html

SEOUL, South Korea--(BUSINESS WIRE)--

SK hynix Inc. (‘SK hynix’ or ‘the Company’) announced that it has entered into an agreement to acquire California-based storage solution company Link_A_Media Devices Corporation (‘LAMD’). LAMD, founded in 2004, is a leader in the development of semiconductor system-on-chip (SoC) solutions for the data storage market. These SoC solutions, also called controllers, interface with processors to significantly increase the speed and reliability of Flash memory. Upon completion of the acquisition, LAMD will join SK hynix as a business unit focused on customized NAND based solutions.

As various mobile applications such as smartphones and tablet PCs are being rapidly adopted and cloud computing grows in popularity, the NAND Flash market has been evolving from raw NAND memory solutions for USB and memory cards to value-added products equipped with controllers. The role of the NAND controller in premium products such as e-MMC (embedded Multi Media Card) and SSDs (Solid State Drives) has become increasingly important to meet the high memory densities and improved interface speeds required by end users.

“We expect our NAND Flash competitiveness will be further strengthened by the acquisition of LAMD which has extensive expertise in controller technology and excellent engineering resources. SK hynix will leverage this acquisition and continuously develop value-added NAND solutions and respond to our customers’ needs,” said Mr. Oh Chul Kwon, President and CEO of SK hynix.

“We are excited to become a part of the SK hynix family. This will enable us to bring our advanced controller solutions to a wide range of data storage products to meet the rapidly increasing demands of the worldwide business and consumer markets,” said Dr. Hemant Thapar, Founder and CEO of LAMD.

Friday, June 15, 2012

Cache SSD Shipments to Explode

"Hybrid hard disk drives (HDD) containing a built-in layer of NAND flash memory may offer the advantage of consolidated storage for increasingly popular ultrabooks, but cache solid state drives (SSD) will remain the mainstream ultrabook storage solution".

In 2012 "cache SSD volume this year to 23.9 million unit...

dedicated SSDs that contain no cache component, will attain shipments this year of 18 million...

hybrid HDDs will reach two million units this year...on their way to reaching 25 million units by 2016"

A key driver of cache SSD is Intel's strong support of ultrabooks.

In January 2012 IHS report "Fueled by rising sales of ultrabooks, shipments of cache SSD units in 2012 are projected to reach 25.7 million units, up from 881,000 units in 2011 when the technology first appeared. Next year, cache SSD shipments will amount to 68.2 million units, on their way to approximately 121.0 million units by 2015, as shown in the figure below.

The majority of cache SSD units will find their way into devices known as ultrabooks—the superthin mobile computers launched by chipmaker Intel in 2011—even though non-ultrabook desktops and notebooks also will account for cache SSD use. Of the more than 25 million cache SSDs to be shipped this year, about 22 million units will be present in ultrabooks, up from a mere 500,000 last year."

Ron

Cache is king in solid state drive market, says IHS

http://www.digitimes.com/news/a20120615PR200.html?mod=2

Press release; Jessie Shen, DIGITIMES [Friday 15 June 2012]

Hybrid hard disk drives (HDD) containing a built-in layer of NAND flash memory may offer the advantage of consolidated storage for increasingly popular ultrabooks, but cache solid state drives (SSD) will remain the mainstream ultrabook storage solution, according to IHS iSuppli.

Already the leading storage form factor in ultrabooks, cache SSDs will see their shipments rise even more this year to 23.9 million units, up by an astounding 2,660% from just 864,000 units in 2011, IHS said. Shipments will then jump to 67.7 million units in 2013, cross the hundred-million-unit mark in 2015, and hit 163 million units by 2016, IHS forecast.

In comparison, shipments of hybrid HDDs will reach two million units this year, up from one million in 2011, on their way to reaching 25 million units by 2016, IHS indicated. A third form of flash storage, dedicated SSDs that contain no cache component, will attain shipments this year of 18 million in consumer applications, gradually ramping up to 69 million units in 2016, IHS said.

Consisting of a traditional HDD and an integrated NAND flash layer within one self-contained form factor, hybrid HDDs are a new storage option being considered for the super-thin ultrabooks. The Momentus XT hybrid product from Seagate Technology has up to 8GB of single-level-cell NAND and 750GB of memory on two 2.5-inch platters. Seagate rivals Western Digital and Toshiba are also considering hybrid HDDs of their own, with drives containing 8GB or more of NAND cache.

In contrast to hybrid HDDs, cache SSDs are employed as a discrete, separate memory component alongside a HDD, with both elements existing side by side, not together in one housing unit. A sample cache SSD configuration from Acer's Aspire S3 ultrabook carried a 20GB SSD next to 320GB of hard disk space.

"The cache SSD solution was first hit upon by PC manufacturers because the use of a dedicated solid state drive proved too expensive when passed on to consumers in the retail market," said Ryan Chien, analyst for memory & storage at IHS. "However, a combined physical hard disk drive with a smaller cache component allowed PC makers to reap the advantages of faster responsiveness and larger capacities while keeping costs down."

Cache SSDs also offer more advantages than consolidated hybrid HDDs. For instance, discrete cache SSDs and HDDs are much more scalable and efficient for mainstream storage, given the broad selection of drive manufacturers, IHS said. And because SSDs and HDDs have lately been focused on more mobile sizes, few changes are needed for cache SSDs or thin HDDs to keep their manufacturing processes cost effective.

Moreover, the expected evolution of cache SSDs to a swappable mSATA form factor not only helps narrow the convenience advantage currently enjoyed by hybrid HDDs but also facilitates upgradability akin to DRAM modules or USB drives, IHS noted. HDDs sized 7mm are available with 500GB in 2.5-inch platters, with a 5mm z-height as the next step, while hybrid HDDs are still 9mm high. SATA SSDs are also getting denser, and NAND on the motherboard is becoming more feasible.

Such benefits overall highlight the strength of discrete, dedicated hardware emblematic of cache SSDs over those of hybrids, which tend to make compromises in exchange for volume implementation, IHS said. Cost concerns, longer design cycles and tighter engineering tolerances in the case of hybrid HDDs also add to their difficulty of use in ultrabooks, IHS added.

As a result, the gain achieved through a consolidated form factor supposed to be a strength of hybrid HDDs will actually be a weakness in a few years as cache SSDs overcome that advantage, IHS said. For their part, cache SSDs will remain as the favored storage solution in ultrabooks, with penetration of the desktop and the rest of the notebook segments anticipated to follow.

In 2012 "cache SSD volume this year to 23.9 million unit...

dedicated SSDs that contain no cache component, will attain shipments this year of 18 million...

hybrid HDDs will reach two million units this year...on their way to reaching 25 million units by 2016"

A key driver of cache SSD is Intel's strong support of ultrabooks.

In January 2012 IHS report "Fueled by rising sales of ultrabooks, shipments of cache SSD units in 2012 are projected to reach 25.7 million units, up from 881,000 units in 2011 when the technology first appeared. Next year, cache SSD shipments will amount to 68.2 million units, on their way to approximately 121.0 million units by 2015, as shown in the figure below.

The majority of cache SSD units will find their way into devices known as ultrabooks—the superthin mobile computers launched by chipmaker Intel in 2011—even though non-ultrabook desktops and notebooks also will account for cache SSD use. Of the more than 25 million cache SSDs to be shipped this year, about 22 million units will be present in ultrabooks, up from a mere 500,000 last year."

Ron

Cache is king in solid state drive market, says IHS

http://www.digitimes.com/news/a20120615PR200.html?mod=2

Press release; Jessie Shen, DIGITIMES [Friday 15 June 2012]

Hybrid hard disk drives (HDD) containing a built-in layer of NAND flash memory may offer the advantage of consolidated storage for increasingly popular ultrabooks, but cache solid state drives (SSD) will remain the mainstream ultrabook storage solution, according to IHS iSuppli.

Already the leading storage form factor in ultrabooks, cache SSDs will see their shipments rise even more this year to 23.9 million units, up by an astounding 2,660% from just 864,000 units in 2011, IHS said. Shipments will then jump to 67.7 million units in 2013, cross the hundred-million-unit mark in 2015, and hit 163 million units by 2016, IHS forecast.

In comparison, shipments of hybrid HDDs will reach two million units this year, up from one million in 2011, on their way to reaching 25 million units by 2016, IHS indicated. A third form of flash storage, dedicated SSDs that contain no cache component, will attain shipments this year of 18 million in consumer applications, gradually ramping up to 69 million units in 2016, IHS said.

Consisting of a traditional HDD and an integrated NAND flash layer within one self-contained form factor, hybrid HDDs are a new storage option being considered for the super-thin ultrabooks. The Momentus XT hybrid product from Seagate Technology has up to 8GB of single-level-cell NAND and 750GB of memory on two 2.5-inch platters. Seagate rivals Western Digital and Toshiba are also considering hybrid HDDs of their own, with drives containing 8GB or more of NAND cache.

In contrast to hybrid HDDs, cache SSDs are employed as a discrete, separate memory component alongside a HDD, with both elements existing side by side, not together in one housing unit. A sample cache SSD configuration from Acer's Aspire S3 ultrabook carried a 20GB SSD next to 320GB of hard disk space.

"The cache SSD solution was first hit upon by PC manufacturers because the use of a dedicated solid state drive proved too expensive when passed on to consumers in the retail market," said Ryan Chien, analyst for memory & storage at IHS. "However, a combined physical hard disk drive with a smaller cache component allowed PC makers to reap the advantages of faster responsiveness and larger capacities while keeping costs down."

Cache SSDs also offer more advantages than consolidated hybrid HDDs. For instance, discrete cache SSDs and HDDs are much more scalable and efficient for mainstream storage, given the broad selection of drive manufacturers, IHS said. And because SSDs and HDDs have lately been focused on more mobile sizes, few changes are needed for cache SSDs or thin HDDs to keep their manufacturing processes cost effective.

Moreover, the expected evolution of cache SSDs to a swappable mSATA form factor not only helps narrow the convenience advantage currently enjoyed by hybrid HDDs but also facilitates upgradability akin to DRAM modules or USB drives, IHS noted. HDDs sized 7mm are available with 500GB in 2.5-inch platters, with a 5mm z-height as the next step, while hybrid HDDs are still 9mm high. SATA SSDs are also getting denser, and NAND on the motherboard is becoming more feasible.

Such benefits overall highlight the strength of discrete, dedicated hardware emblematic of cache SSDs over those of hybrids, which tend to make compromises in exchange for volume implementation, IHS said. Cost concerns, longer design cycles and tighter engineering tolerances in the case of hybrid HDDs also add to their difficulty of use in ultrabooks, IHS added.

As a result, the gain achieved through a consolidated form factor supposed to be a strength of hybrid HDDs will actually be a weakness in a few years as cache SSDs overcome that advantage, IHS said. For their part, cache SSDs will remain as the favored storage solution in ultrabooks, with penetration of the desktop and the rest of the notebook segments anticipated to follow.

Hynix Developing PCM, MRAM, and ReRAM Flash

To cut down cost and development risk Hynix is working with IBM on PCM type of flash memory. Hynix is already working on other future approaches such as PCM, MRAM, and ReRAM Flash (see more below).

Some background information on PCM, MRAM, and ReRAM Flash at Pushing the PRAM: when chips just can't get any smaller more information is at Flash educational links

Ron

SK Hynix, IBM form chip development alliance

http://www.zdnetasia.com/sk-hynix-ibm-form-chip-development-alliance-62305070.htm

By Ellyne Phneah , ZDNet Asia on June 11, 2012 (9 hours ago)

Summary

Korean chipmaker and Big Blue to develop phase-change random access memory (PcRAM), a non-volatile chip that can store high data volumes, amid rising popularity of mobile devices.

SK Hynix has formed an alliance with IBM to develop phase-change random access memory (PcRAM), which is considered to be the next generation of memory chips and capable of storing high data volumes.

According to Song Hyeon-jeong, head of the SK Hynix's future strategy office in the Korea Times on Sunday, the collaboration will help the Korean chip manufacturer strengthen its capabilities to better compete with rivals in next-generation chips. PcRAM is a non-volatile memory chip which uses the property of chalcogenide glass to switch between both states, and is touted to be able to store a lot of data but is slower than convential dynamic random access-memory (DRAM) chip.

The alliance also reflects efforts to develop advanced chips in light of the rising popularity of smartphones and tablets. SK Hynix said it was unable to survive with existing chips--NAND flash and DRAM--which were expected to be obsolete in a few years, the report noted.

As the chip-making structure of PcRAM was simple, the company said it would save on manufacturing as PcRAM applications would need the corresponding phase-change process to be induced by an electricial current and a significant-higher packing density of information.

SK Hynix since last year also had been working with Japanese chipmaker, Toshiba, on the development of magnetoresistive random access memory (MRAM), which is able to pack memory in a denser manner, according to a seperate report by the Korea Times. The Korean chipmaker had been developing resistive random access memory (ReRAM) with Hewlett-Packard (HP) since 2010, which was found to store twice as much data and use less energy than flash memory.

Some background information on PCM, MRAM, and ReRAM Flash at Pushing the PRAM: when chips just can't get any smaller more information is at Flash educational links

Ron

SK Hynix, IBM form chip development alliance

http://www.zdnetasia.com/sk-hynix-ibm-form-chip-development-alliance-62305070.htm

By Ellyne Phneah , ZDNet Asia on June 11, 2012 (9 hours ago)

Summary

Korean chipmaker and Big Blue to develop phase-change random access memory (PcRAM), a non-volatile chip that can store high data volumes, amid rising popularity of mobile devices.

SK Hynix has formed an alliance with IBM to develop phase-change random access memory (PcRAM), which is considered to be the next generation of memory chips and capable of storing high data volumes.

According to Song Hyeon-jeong, head of the SK Hynix's future strategy office in the Korea Times on Sunday, the collaboration will help the Korean chip manufacturer strengthen its capabilities to better compete with rivals in next-generation chips. PcRAM is a non-volatile memory chip which uses the property of chalcogenide glass to switch between both states, and is touted to be able to store a lot of data but is slower than convential dynamic random access-memory (DRAM) chip.

The alliance also reflects efforts to develop advanced chips in light of the rising popularity of smartphones and tablets. SK Hynix said it was unable to survive with existing chips--NAND flash and DRAM--which were expected to be obsolete in a few years, the report noted.

As the chip-making structure of PcRAM was simple, the company said it would save on manufacturing as PcRAM applications would need the corresponding phase-change process to be induced by an electricial current and a significant-higher packing density of information.

SK Hynix since last year also had been working with Japanese chipmaker, Toshiba, on the development of magnetoresistive random access memory (MRAM), which is able to pack memory in a denser manner, according to a seperate report by the Korea Times. The Korean chipmaker had been developing resistive random access memory (ReRAM) with Hewlett-Packard (HP) since 2010, which was found to store twice as much data and use less energy than flash memory.

Wednesday, June 13, 2012

Apple's iPad, iCloud Drive Semiconductor Industry

Apple's increased usage of NAND flash memory for storage is changing the semiconductor industry.

"Apple's top-end MacBook Pro won't have a hard drive -- the new ones will run only solid-state drives -- marks the latest, and perhaps most important move in an an industry trend towards SSD-only systems that use cloud-based storage services"....

"Apple's iPad tablet is expected to dominate worldwide demand for NAND flash in media tablets at least through 2015" (in millions of Gigabytes).

Ron

Apple's all-flash MacBook Pro, iCloud drive industry changes

http://www.computerworld.com/s/article/9227960/Apple_s_all_flash_MacBook_Pro_iCloud_drive_industry_changes

The MacBook Pro now comes with a 768GB SSD option, and automatic access to Apple's iCloud services

By Lucas Mearian

June 11, 2012 03:41 PM ET7 Comments. What's this?.Computerworld - Today's announcement that Apple's top-end MacBook Pro won't have a hard drive -- the new ones will run only solid-state drives -- marks the latest, and perhaps most important move in an an industry trend towards SSD-only systems that use cloud-based storage services.

Pricing for Apple's top-end MacBook Pro starts at $2,199 and includes a 2.3GHz quad-core chip, 8GB of RAM and 256GB SSD. Apple also announced 512GB and 768GB SSD MacBook Pro models.

The new MacBook Pro is 0.71 inches thick, weighs 4.46 pounds and uses Apple's latest Retina display technology.

Apple also announced a 512GB SSD option for its MacBook Air netbook, which doubles capacity from the previous 256GB maximum flash capacity.

Apple Monday also announced that its iCloud online storage service will be included with its laptops, doing for data and applications what the iTunes service did for digital music.

From here on out, anytime a user signs into a new MacBook Pro or Air with their Apple ID, the systems will automatically configure apps to work with iCloud. Anything stored in its cloud will be accessible on any other devices with the iCloud download.

The combination of SSD and cloud should be a powerful driver of laptop systems, said Andrew Reichmann, an analyst with Forrester Research.

Large hard drives will no longer be considered an advantage in laptops, as higher performing machines store frequently accessed data locally and everything else in the cloud.

Apple is currently the world's largest consumer of semiconductor technology. Apple currently uses NAND flash in its iPad, iPod, iPhone, MacBook Air and MacBook Pro lines. The iPad alone accounted for 78% of global NAND technology shipments in 2011.

According to IHS iSuppli, Apple's iPad tablet is expected to dominate worldwide demand for NAND flash in media tablets at least through 2015.

Ryan Chien, an SSD and storage analyst with IHS iSuppli, said today's MacBook Pro announcement is not as significant as last year's MacBook Air redesign or Intel s Ultrabook introduction because the SSD-equipped MacBook Pros are very premium products.

He said the MacBook Pro's use of SSD really won't "move the needle" in terms of the competitive landscape for PC storage or flash procurement, "as NAND usage from SSDs is far outpaced by smartphones and tablets."

"I believe what today signifies is a reaffirmation of Apple's commitment toward an aggressive Mac roadmap, and another step in aligning its computers with the runaway success of its mobile devices," Chien said

"And, increased SSD penetration on the Mac side is key to helping accentuate the unified Apple experience across all client devices in terms of performance and capabilities," he added.

The aggressive move into SSDs also sets the stage for deeper implementation of device-agnostic systems like iCloud and AirPlay, Chien said.

2012 Q1 Ranking: Toshiba Outperforms NAND Market

Toshiba grew faster than other manufacturers in the NAND market during Q1 of 2012 (see below).

The patent wars between Samsung and Apple helped Toshiba advance since Apple is currently the world's largest consumer of semiconductor technology and probably increased its purchases from Toshiba.

Apple currently uses NAND flash in its iPad, iPod, iPhone, MacBook Air and MacBook Pro lines. The iPad alone accounted for 78% of global NAND technology shipments in 2011.

I am wondering how Sandisk did in Q1 since IHS iSuppli does not includes it in its NAND ranking.

Ron

Toshiba shines in Q1 NAND rankings

http://eetimes.com/electronics-news/4375298/Toshiba-shines-in-Q1-NAND-rankings-

Dylan McGrath

6/13/2012 11:33 AM EDT

Japan's Toshiba posted NAND flash memory sales of $1.71 billion in the first quarter, up 19 percent from the fourth quarter of 2011, the highest growth rate among all NAND suppliers, and good for a 34 percent share of the NAND market, according to IHS iSuppli. BELLEVUE, Wash.—Japan's Toshiba Corp. posted NAND flash memory sales of $1.71 billion in the first quarter, up 19 percent from the fourth quarter of 2011, the highest growth rate among all NAND suppliers, and good for a 34 percent share of the NAND market, according to IHS iSuppli.

Toshiba retained its No. 2 position among NAND suppliers in the first quarter, trailing only South Korea's Samsung Electronics Co. Ltd., which held 37 percent of the market, according to IHS.

Toshiba's robust NAND sales growth in the first quarter was even more impressive considering that the NAND flash market as a whole declined by 1 percent during the quarter, according to IHS. All other NAND suppliers experienced sales decreases in the quarter, the firm said.

Overall first-quarter NAND flash sales amounted to $4.99 billion, from $5.05 billion in the fourth quarter last year, IHS said.

In achieving 34 percent first quarter growth, Toshiba shook off troubles experienced in 2011, when Toshiba's production was disrupted by the March 11 earthquake and tsunami in Japan and later, when Toshiba's sales—like all NAND suppliers—were hurt by market conditions that caused a carryover of inventory into the first quarter of this year, according to Dee Nguyen, memory analyst at IHS.

"Toshiba’s strong results show that the company has regained its footing and has put a tumultuous year behind it," Dee said, in a statement.

Overall, the NAND market was dragged down in the first quarter by weak pricing, which reflected the mismatch between an industry-wide growth in supply and a seasonally slow quarter for consumer demand, IHS said. With the exception of Toshiba, NAND suppliers experienced revenue declines that ranged from a soft landing for Samsung to a steep drop-off for Powerchip Technology Corp., IHS said.

Samsung logged first quarter NAND sales of $1.86 billion, down 4 percent from $1.94 billion in the fourth quarter of 2011, IHS said. The firm's market share decreased by one point in the first quarter compared to the fourth quarter of 2011, IHS said.

Powerchip's NAND sales declined 35 percent sequentially in the first quarter, while SK Hynix Inc. and Micron Technology Inc. saw sequential NAND sales declines of 14 percent and 17 percent, respectively, IHS said.

IHS blamed Samsung’s decline on a10 percent fall in the average selling price (ASP) of its NAND product and Samsung's throttling production in one of its fabs while preparing to transition to the firm’s System LSI division that makes processors and chip sets. The company is optimistic, however, about a better environment in the second quarter, as handset and PC manufacturers launch new products for the upcoming high-demand seasons, IHS said.

The patent wars between Samsung and Apple helped Toshiba advance since Apple is currently the world's largest consumer of semiconductor technology and probably increased its purchases from Toshiba.

Apple currently uses NAND flash in its iPad, iPod, iPhone, MacBook Air and MacBook Pro lines. The iPad alone accounted for 78% of global NAND technology shipments in 2011.

I am wondering how Sandisk did in Q1 since IHS iSuppli does not includes it in its NAND ranking.

Ron

Toshiba shines in Q1 NAND rankings

http://eetimes.com/electronics-news/4375298/Toshiba-shines-in-Q1-NAND-rankings-

Dylan McGrath

6/13/2012 11:33 AM EDT

Japan's Toshiba posted NAND flash memory sales of $1.71 billion in the first quarter, up 19 percent from the fourth quarter of 2011, the highest growth rate among all NAND suppliers, and good for a 34 percent share of the NAND market, according to IHS iSuppli. BELLEVUE, Wash.—Japan's Toshiba Corp. posted NAND flash memory sales of $1.71 billion in the first quarter, up 19 percent from the fourth quarter of 2011, the highest growth rate among all NAND suppliers, and good for a 34 percent share of the NAND market, according to IHS iSuppli.

Toshiba retained its No. 2 position among NAND suppliers in the first quarter, trailing only South Korea's Samsung Electronics Co. Ltd., which held 37 percent of the market, according to IHS.

Toshiba's robust NAND sales growth in the first quarter was even more impressive considering that the NAND flash market as a whole declined by 1 percent during the quarter, according to IHS. All other NAND suppliers experienced sales decreases in the quarter, the firm said.

Overall first-quarter NAND flash sales amounted to $4.99 billion, from $5.05 billion in the fourth quarter last year, IHS said.

In achieving 34 percent first quarter growth, Toshiba shook off troubles experienced in 2011, when Toshiba's production was disrupted by the March 11 earthquake and tsunami in Japan and later, when Toshiba's sales—like all NAND suppliers—were hurt by market conditions that caused a carryover of inventory into the first quarter of this year, according to Dee Nguyen, memory analyst at IHS.

"Toshiba’s strong results show that the company has regained its footing and has put a tumultuous year behind it," Dee said, in a statement.

Overall, the NAND market was dragged down in the first quarter by weak pricing, which reflected the mismatch between an industry-wide growth in supply and a seasonally slow quarter for consumer demand, IHS said. With the exception of Toshiba, NAND suppliers experienced revenue declines that ranged from a soft landing for Samsung to a steep drop-off for Powerchip Technology Corp., IHS said.

Samsung logged first quarter NAND sales of $1.86 billion, down 4 percent from $1.94 billion in the fourth quarter of 2011, IHS said. The firm's market share decreased by one point in the first quarter compared to the fourth quarter of 2011, IHS said.

Powerchip's NAND sales declined 35 percent sequentially in the first quarter, while SK Hynix Inc. and Micron Technology Inc. saw sequential NAND sales declines of 14 percent and 17 percent, respectively, IHS said.

IHS blamed Samsung’s decline on a10 percent fall in the average selling price (ASP) of its NAND product and Samsung's throttling production in one of its fabs while preparing to transition to the firm’s System LSI division that makes processors and chip sets. The company is optimistic, however, about a better environment in the second quarter, as handset and PC manufacturers launch new products for the upcoming high-demand seasons, IHS said.

Friday, June 8, 2012

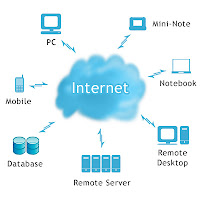

Cloud Storage, Servers Drive IC Demand

DRAM manufacturers such as Samsung, Hynix, and Micron will benefit from the new demand for storage and servers (see below).

Intel benefited from it last quarter. Intel, which also supplies chips to the slow-growing PC market, increased its revenues by 20%. They had more than $10 billion in revenues from ICs sold to data centers, for servers, storage products, and networking. It is likely that databases and cloud servers (20% of sales, 3x PC segment growth) added to Intel's growth in 2011.

Ron

DRAM troubles come to an end, key to success is cloud storage

http://electronicsfeed.com/news/2373

Staff Editor

According to TrendForce, this year’s biggest DRAM industry event, the announcement that Japanese manufacturer Elpida will join hands with U.S. maker Micron, marks the end of a perfectly competitive market as Samsung, Hynix, and the new Micron team become the three main players in an oligopolistic market.

Share on linkedinShare on printShare on emailMore Sharing Services10 hours ago DRAMeXchange, a research division of TrendForce, indicates there is hope for DRAM price recovery, forecasting a 15% decrease in yearly DRAM revenue and a 30% yearly bit shipment increase in 2012. 1Gb average selling price is expected to fall by around 30% this year, an improvement over last year’s 50% decrease.

The future of the DRAM market will see a transition from PC DRAM to server and mobile DRAM, important for the cloud storage sector, and it would be prudent for Taiwanese makers to speed up production integration to lower the risk of overreliance on PC DRAM.

Unable to Withstand Rise of Mobile Sector, DRAM Makers’Profits Decrease as Prices Fall

In 2008, the DRAM industry was hit hard by the global financial crisis – German memory maker Qimonda withdrew from the market, and Taiwanese DRAM manufacturers saw capacity cuts of nearly 60%. As the economy gradually recovered, demand exceeded supply, giving DRAM makers a year and a half of good business – DRAM average selling price rose by 8.9% in 2010.

Bit output increased as well, and DRAM industry value grew by 72.8% compared to 2009. In 2011, DRAM production increased by 50% over the previous year, as manufacturers continued to advance two generations of process technology a year. With the rise of smartphones and tablet PCs, PC DRAM was in severe oversupply in 2011, with a 50% decrease in average selling price compared to 2010, and a 24.6% decrease in DRAM industry value.

Aside from industry leader Samsung, none of the memory manufacturers came away without losses, and only a handful of makers remain in the once populated industry.

Samsung Safe with Strength in Technology Migration and Product Mix

TrendForce indicates, bit growth is no longer the key to profitability. Continued technology migration is necessary, but a flexible product mix is a must to cater to the constantly changing demands of the market. For instance, in the first quarter of 2012, Samsung not only dominated the mobile DRAM sector with nearly 60% market share, but the maker was also the most aggressive in transitioning to 30nm process technology in the mobile DRAM sector.

The Korean heavyweight was the only DRAM manufacturers to see profits in 1Q12, an indication that technology migration is not the only prerequisite to profitability – proper product mix is a necessity as well.

In conclusion, in the coming oligopolistic market era DRAM makers will need to be reborn to enjoy the fruits of their labor once again, and only improving product diversification and increasing added value will bring profitability.

Read more: http://electronicsfeed.com/news/2373

Intel benefited from it last quarter. Intel, which also supplies chips to the slow-growing PC market, increased its revenues by 20%. They had more than $10 billion in revenues from ICs sold to data centers, for servers, storage products, and networking. It is likely that databases and cloud servers (20% of sales, 3x PC segment growth) added to Intel's growth in 2011.

Ron

DRAM troubles come to an end, key to success is cloud storage

http://electronicsfeed.com/news/2373

Staff Editor

According to TrendForce, this year’s biggest DRAM industry event, the announcement that Japanese manufacturer Elpida will join hands with U.S. maker Micron, marks the end of a perfectly competitive market as Samsung, Hynix, and the new Micron team become the three main players in an oligopolistic market.

Share on linkedinShare on printShare on emailMore Sharing Services10 hours ago DRAMeXchange, a research division of TrendForce, indicates there is hope for DRAM price recovery, forecasting a 15% decrease in yearly DRAM revenue and a 30% yearly bit shipment increase in 2012. 1Gb average selling price is expected to fall by around 30% this year, an improvement over last year’s 50% decrease.

The future of the DRAM market will see a transition from PC DRAM to server and mobile DRAM, important for the cloud storage sector, and it would be prudent for Taiwanese makers to speed up production integration to lower the risk of overreliance on PC DRAM.

Unable to Withstand Rise of Mobile Sector, DRAM Makers’Profits Decrease as Prices Fall

In 2008, the DRAM industry was hit hard by the global financial crisis – German memory maker Qimonda withdrew from the market, and Taiwanese DRAM manufacturers saw capacity cuts of nearly 60%. As the economy gradually recovered, demand exceeded supply, giving DRAM makers a year and a half of good business – DRAM average selling price rose by 8.9% in 2010.

Bit output increased as well, and DRAM industry value grew by 72.8% compared to 2009. In 2011, DRAM production increased by 50% over the previous year, as manufacturers continued to advance two generations of process technology a year. With the rise of smartphones and tablet PCs, PC DRAM was in severe oversupply in 2011, with a 50% decrease in average selling price compared to 2010, and a 24.6% decrease in DRAM industry value.

Aside from industry leader Samsung, none of the memory manufacturers came away without losses, and only a handful of makers remain in the once populated industry.

Samsung Safe with Strength in Technology Migration and Product Mix

TrendForce indicates, bit growth is no longer the key to profitability. Continued technology migration is necessary, but a flexible product mix is a must to cater to the constantly changing demands of the market. For instance, in the first quarter of 2012, Samsung not only dominated the mobile DRAM sector with nearly 60% market share, but the maker was also the most aggressive in transitioning to 30nm process technology in the mobile DRAM sector.

The Korean heavyweight was the only DRAM manufacturers to see profits in 1Q12, an indication that technology migration is not the only prerequisite to profitability – proper product mix is a necessity as well.

In conclusion, in the coming oligopolistic market era DRAM makers will need to be reborn to enjoy the fruits of their labor once again, and only improving product diversification and increasing added value will bring profitability.

Read more: http://electronicsfeed.com/news/2373

Labels:

chip,

Circuit,

circuit expert,

circuit experts,

cloud,

DDR,

Design,

DRAM,

expert,

IC,

LPDDR,

Memory,

microprocessor,

mobile,

NAND,

NOR,

PC,

server,

Smartphone,

testify

Thursday, June 7, 2012

Intel, Google and Smartphones

The article below raises an important point. Intel can get ahead in the smart phone market by working closely together with Google on next generation mobile phones.

Both can benefit by combining Intel's advanced processing and design prowess with Google's software and hardware capabilities.

See more about Intel, Google, and mobile phones in the enterprise market at Intel to Target Enterprise by Including vPro in Smartphones

Ron

Intel Chips on Android based Motorola and Lenovo Smart Phones

http://nucleation.blogspot.com/2012/01/intel-chips-on-android-based-motorola.html?m=1

Intel Chips on Android based Motorola and Lenovo Smart Phones Intel has made an announcement at Consumer Electronics Show (CES) that Motorola Mobility and Lenovo will use their new chip designed for mobile devices on upcoming Android based smart phones. Intel even demoed its own prototype smart phone built using the new chip Medfield.

Medfield chip will help Intel in entering the mobile process sector, dominated by Arm Holdings. This is Intel's second attempt to have their chips on smart phones. In CES 2010, LG had announced a tie up with Intel, which never found light. This time Intel has even announced some rough shipping dates. Lenovo would launch a Medfield-based phone by July in China and Motorola in second half this year.

Designed to balance processing power against energy use the chip helps in maximising battery life. With Intel's well-established 32-nanometre technology, the chip packs C86-architecture central processing unit (CPU), RAM Memory, storage and graphics processing unit all onto the same chip. The prototype unit that Intel demoed in CES could deliver eight hours of 3G voice calls, six hours of 1080p video decoding or five hours of 3G internet browsing.

In an interview given to BBC, Intel's Ultra Mobility Group General Manager told, "Battery life on this platform is not the best in the mobile market, but it is by far not the worst. We are very effective and good at some tasks and sort of in the middle of the pack at others. Essentially, we think you can build a Smartphone based upon our processor with an ordinary sized battery that you see in today's smart phones that will provide a great experience. There will be no battery life issue on our platform."

Intel claims to have taken steps to prevent existing Android apps from being incompatible or slow on its chips.

Intel says that it has developed a technology to tackle 25% of apps designed specifically to run on ARM-based processors.

These applications may consume more power than applications developed for Intel chips. This power consumption will not be so noticeable by end users. Intel is planning to use the chip in tablets at a later stage. However, for now Intel is promoting a Clover Trail processor for tablets running the upcoming Windows 8 system. There have been discussions in Intel to move into mobile manufacturing sector also. That may happen only in distant future. For the success of Intel, it is important for them to crack a way into the mobile device market. With the advent of new technologies, gap between smart phones and tablets versus PCs and laptops will become narrow. Manufacturers have started experimenting ARM-based laptops running Linux Operating system.

To be on the run, Intel needs to grow its business at a significant rate and must participate in this market.

Labels:

battery,

Battery Life,

Circuit,

circuit expert,

circuit experts,

DDR,

Design,

Device,

DRAM,

enterprise,

expert,

LPDDR,

Memory,

NAND,

NOR,

Process,

security,

SoC,

testify

Friday, June 1, 2012

Apple Television; Interface, Design, App...

Apple analyst Gene Munster of Piper Jaffray been right many times in his predictions about Apple.

He predicts that Apple TV will take the following directions:

1. Interface: The TVwill include Siri...

2. TV design: ...will include many existing Apple styling cues including aluminum casing and reduction of wires....

3. Apps/Games: Ultimately enable the App Store through the TV so that consumers can play games, listen to music...

(See more below)

I wonder about how large the impact of these TVs will be on growth for semiconductor chips such as flash memory, SSD drive, and other ICs.

Ron

Apple Television Is Coming, This Is Why It's Going To Be Revolutionary

http://www.businessinsider.com/apple-television-what-to-expect-2012-6

Jay Yarow

Jun 01 10:21AM

Apple analyst Gene Munster of Piper Jaffray has a big report on Apple's plans for the TV industry.

He says it's a question of "when" Apple releases its television, not "if" now.

However, he says a lot of analysts are hung up on the idea that Apple will not release a television if it can't do something special with content. He thinks this is wrong.

What will make the Apple television special isn't blowing up the cable industry, it's the interface that it will deliver for users.

While users, and maybe even Apple, want to be able to deliver "unbundled" content, or individual channels, the people in charge of those channels aren't going to let it happen any time soon.

As a result, Apple won't fight the power, right away.

Here's his take on what Apple will do with content: