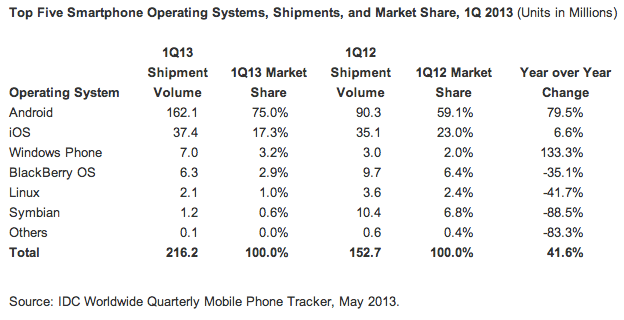

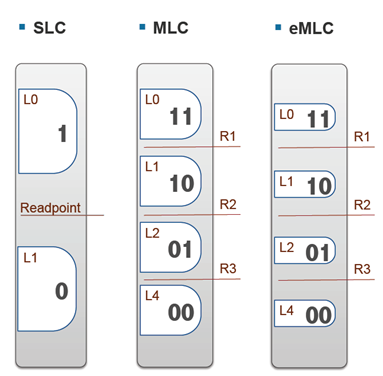

- "MLC dominated the NAND market in CQ1 with 77.9% share, up 8% quarter on quarter.

- TLC (3bit/cell) is gaining traction and rose 8% from quarter-to-quarter.

- Samsung is the only company shipping TLC-based SSDs in volume.

- SLC is declining quickly as demand transitions to MLC, except in certain high performance, high-endurance applications such as military, industrial, medical and automotive."

Additional details below.

More about Cache SSD Shipments to Explode and Apple's iPad, iCloud Drive Semiconductor Industry reports from June 2012

Ron

Insightful, timely, and accurate semiconductor consulting.

Semiconductor information and news at - http://www.maltiel-consulting.com/

SSD Units Grew 22% from 4Q12 to 1Q13 - Trendfocus

This is a Press Release edited by StorageNewsletter.com on Wed, May 22nd, 2013

http://www.storagenewsletter.com/news/marketreport/trendfocus-ssd-market

Leaders being in order Samsung, SanDisk, Toshiba and Intel

The NAND market continued to heat up, as NAND supply was tight in CQ1 '13 due to healthy demand and supply constraints. Nevertheless, the SSD market grew from the prior quarter to 13.28 million, up 22% quarter on quarter.

In CQ1, the client SSD market was up 19% sequentially to 12.06 million. Enterprise SSD growth rates continue to outpace any seasonal server or storage system softness - this market was up 66% from CQ4 '12, to 1.22 million.

Client SSDs were dominated by NAND suppliers, especially Samsung, who took the lead in selling TLC (3bit/cell) into PC OEMs and the retail channel. Toshiba and SanDisk, who had been the main drivers for TLC in the industry up to this point, could not sustain the momentum and lost share in the market.

The enterprise SSD market is gaining more traction in data centers and cloud storage, as the $/GB metric decreased to levels low enough to drive an inflection in demand. TCO and performance arguments are far more compelling at today's $/GB levels and with costs expected to continue downward, enterprise SSD adoption will continue to grow at rates outpacing other storage devices.

Total SSD Market by Application

(Source: Trendfocus, May 2013)

Total NAND Market Share by Technology

(Source: Trendfocus, May 2013)

(Source: Trendfocus, May 2013)

(Source: Trendfocus, May 2013)

In CQ1, the client SSD market was up 19% sequentially to 12.06 million. Enterprise SSD growth rates continue to outpace any seasonal server or storage system softness - this market was up 66% from CQ4 '12, to 1.22 million.

Client SSDs were dominated by NAND suppliers, especially Samsung, who took the lead in selling TLC (3bit/cell) into PC OEMs and the retail channel. Toshiba and SanDisk, who had been the main drivers for TLC in the industry up to this point, could not sustain the momentum and lost share in the market.

The enterprise SSD market is gaining more traction in data centers and cloud storage, as the $/GB metric decreased to levels low enough to drive an inflection in demand. TCO and performance arguments are far more compelling at today's $/GB levels and with costs expected to continue downward, enterprise SSD adoption will continue to grow at rates outpacing other storage devices.

Total SSD Market by Application

| Units in million | CQ1 '13 actuals | CQ1 '14 Forecast | Y/Y Growth |

| Client SSDs | |||

| Stand-Alone Units | 7.073 | 10.180 | 44% |

| Cache Units | 4.986 | 8.319 | 67% |

| Total | 12.059 | 18.499 | 53% |

| Enterprise SSDs | |||

| SATA Units | 1.009 | 1.151 | 14% |

| SAS Units | 0.170 | 0.198 | 16% |

| PCIe Units | 0.037 | 0.042 | 14% |

| Total | 1.216 | 1.391 | 14% |

| Total SSD Units | 13.275 | 19.890 | 50% |

Total NAND Market Share by Technology

(Source: Trendfocus, May 2013)

(Source: Trendfocus, May 2013)

- Price for SSDs in the spot market continues to rise due to constrained NAND supply. OEM and large-scale contracts can be markedly different than spot market pricing.

- 256GB SSD increased 57% from $145 in January to $227 in first week of May.

- 128GB SSD increased 87% since January to $140.

| in million of units | Client | Enterprise | Total | Share |

| Samsung | 4.092 | 0.060 | 4.152 | 31.3% |

| SanDisk | 2.200 | 0.026 | 2.226 | 16.8% |

| Toshiba | 1.222 | 0.000 | 1.222 | 9.2% |

| Intel | 0.832 | 0.025 | 0.857 | 6.5% |

| HGST | 0.000 | 0.094 | 0.094 | 0.7% |

| STEC | 0.000 | 0.044 | 0.044 | 0.3% |

| Others | 3.713 | 0.967 | 4.680 | 35.3% |

| Total | 12.059 | 1.216 | 13.275 | 100% |

Our comments :

Now Trendfocus is becoming a serious analyst firm in SSDs after being concentrated for several years on HDDs disk heads and media only. Other ones in this flash sector include IDC and IHS iSuppli.

It's a difficult job because there are over 100 SSD makers around the world. It's easier to track HDDs with only three manufacturers remaining.

What is published above is a small abstract of the 29 pages of the Trenfocus report NAND/SSD Information Service - May 13, 2013, CQ1'13 Quarterly Update.

We just found the Californian analysts relatively conservative concerning the growth of the enterprise PCIe SSD market compared to the SAS one, and more globally on enterprise SSDs.

It's a difficult job because there are over 100 SSD makers around the world. It's easier to track HDDs with only three manufacturers remaining.

What is published above is a small abstract of the 29 pages of the Trenfocus report NAND/SSD Information Service - May 13, 2013, CQ1'13 Quarterly Update.

We just found the Californian analysts relatively conservative concerning the growth of the enterprise PCIe SSD market compared to the SAS one, and more globally on enterprise SSDs.